What is Factur-X?

Factur-X is the common name in France for the German-French standard for hybrid electronic invoices, which is currently freely available in version 1.0. It is fully compatible and technically identical to the ZUGFeRD 2.2 version, which is why we are talking about a single version of ZUGFeRD 2.2 / Factur-X 1.0. The hybrid form includes a PDF file for users and XML data for further automated processing of the invoice. The standard is compliant with the European standard EN 16931, which specifies the standards and technical rules for electronic invoicing in Europe to ensure interoperability and compliance with legal regulations.

Factur-X aims to generate added value for suppliers and billers by providing the format with a maximum of information in a structured form. The standard is continuously developed and maintained under the leadership of the French National Forum for Electronic Invoicing and Public Electronic Procurement (FNFE-MPE).Factur-X is at the same time a full readable invoice in a PDF A/3 format, containing all information useful for its treatment, especially in case of discrepancy or absence of automatic matching with orders and / or receptions, and a set of invoice data presented in an XML structured file conformant to EN16931 (syntax CII D16B), complete or not, allowing invoice process automation.

For full specifications, please visit FNFE-MPE website

In order to allow the broadest adoption by any size of companies, and in order to guide them, this standard includes several data profiles:

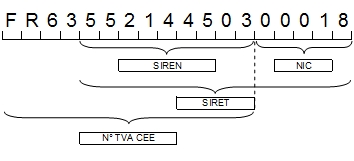

- A SIREN number is your unique French business identification number. This 9 digit number will be requested by all French administration when dealing with you, e.g. URSSAF, RSI, Impot, etc.

- Your SIREN number will be issued by INSEE (national institute of statistics), when you register your business.

- The scheme identifier shall be chosen from a list to be maintained by the Connecting Europe Facility.

- BR-63: The Buyer electronic address (BT-49) shall have a Scheme identifier.

- Fields

- rsm:CrossIndustryInvoice/rsm:SupplyChainTradeTransaction/ram:ApplicableHeaderTradeAgreement/ram:BuyerTradeParty/ram:URIUniversalCommunication/ram:URIID

- rsm:CrossIndustryInvoice/rsm:SupplyChainTradeTransaction/ram:ApplicableHeaderTradeAgreement/ram:BuyerTradeParty/ram:URIUniversalCommunication/ram:URIID/@schemeID

SIRENE Number:

<ram:URIUniversalCommunication>

<ram:URIID schemeID="0002">552144503</ram:URIID>

</ram:URIUniversalCommunication>

SIRET Number:<ram:URIUniversalCommunication><ram:URIID schemeID="0009">55214450300018</ram:URIID></ram:URIUniversalCommunication>

- CPRO management rules : Specific management rules

- Standard EN16931 rules : Management rules of the standard

- Business Rules VAT related

- Business Rules, integrity constraints and conditions

- EN16931 Code lists : Repositories available for each data item (BT) resulting in a repository

- Invoice Type Code

- Payment means code

- BT-145 / BT-105 (charge reason code)

- Allowance identification code : BT-140 / BT-98

- Unit of Measure : BT-130 / BT-150

- Text subject code qualifier : BT-21

- Country Code list : BT-40, BT-48, BT-55, BT-63, BT-69, BT-80, BT-159

- ISO 4217

- Reference code Identifier : BT-18-1, BT-128-1

- Item type identification code : BT-158-1

- ISO 6523 : BT-29, BT-30, BT-46, BT-47, BT-60, BT-61, BT-71

- Electronice Address Scheme : BT-34-1, BT-49-1

- CEF VATEX — VAT exemption reason code : BT-121

- CEFUTDID 2475 Subset : BT-8

- MIME : BT-125-1

- 5305 Duty or tax or fee category code 121 : BT-151 ET BG-20 ET BT-95 ET BT-102 ET BT-118